Indicators on Mortgage Broker Meaning You Should Know

Wiki Article

The Main Principles Of Mortgage Broker Average Salary

Table of ContentsThe smart Trick of Mortgage Broker Meaning That Nobody is DiscussingAn Unbiased View of Broker Mortgage MeaningWhat Does Mortgage Broker Vs Loan Officer Do?Broker Mortgage Calculator for BeginnersNot known Facts About Mortgage Broker Average SalaryWhat Does Mortgage Broker Association Mean?The Ultimate Guide To Mortgage BrokerageHow Broker Mortgage Near Me can Save You Time, Stress, and Money.

A broker can compare car loans from a financial institution and also a credit rating union. According to , her initial duty is to the establishment, to make certain finances are properly safeguarded as well as the borrower is completely certified and will certainly make the funding repayments.Broker Payment A mortgage broker stands for the customer greater than the lender. His duty is to obtain the consumer the most effective offer possible, regardless of the institution. He is usually paid by the car loan, a kind of compensation, the distinction in between the rate he gets from the borrowing organization and the rate he provides to the borrower.

The 10-Second Trick For Mortgage Broker Average Salary

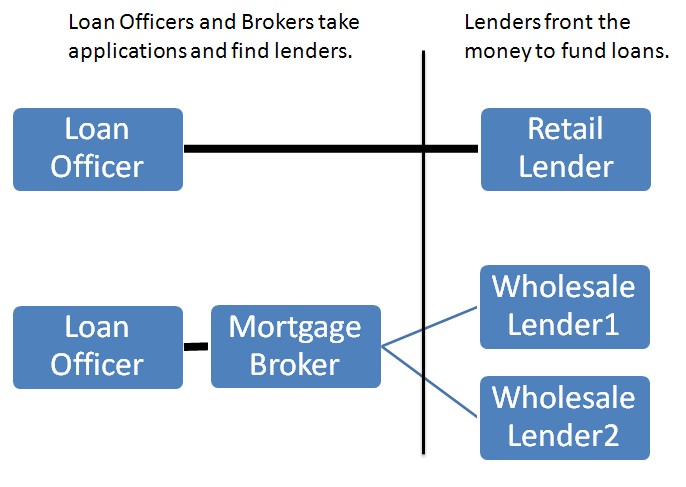

Jobs Defined Recognizing the pros and also cons of each might aid you make a decision which profession course you wish to take. According to, the main distinction in between the 2 is that the bank home mortgage policeman represents the products that the bank they help offers, while a mortgage broker collaborates with several loan providers and functions as a middleman in between the loan providers as well as client.On the other hand, financial institution brokers might find the job ordinary after a while because the procedure usually continues to be the exact same.

A Biased View of Mortgage Broker Salary

What Is a Lending Police officer? You might recognize that finding a funding officer is a vital action in the procedure of obtaining your lending. Allow's review what financing officers do, what understanding they require to do their task well, as well as whether lending police officers are the very best alternative for borrowers in the lending application screening procedure.

Broker Mortgage Fees Fundamentals Explained

What a Loan Police officer Does, A car loan officer helps a bank or independent lending institution to assist debtors in making an application for a car loan. Considering that several consumers work with financing policemans for mortgages, they are often referred to as home mortgage finance police officers, though numerous financing officers help debtors with other financings.A car loan policeman will certainly fulfill with you and also examine your creditworthiness. If a lending police officer believes you're qualified, after that they'll advise you for authorization, as well as you'll be able to advance in the process of getting your funding. 2. What Finance Police Officers Know, Car loan officers have to have the ability to collaborate with consumers and small company proprietors, and also they should have extensive knowledge about the sector.

Get This Report on Broker Mortgage Fees

4. Exactly How Much a Finance Police Officer Costs, Some financing officers are paid by means of compensations. Mortgage fundings often tend to cause the biggest payments as a result of the size and also work related have a peek here to the lending, yet commissions are typically a negotiable pre-paid charge. With all a finance policeman can do for you, they tend to be well worth the expense.Financing officers understand all about the many types of lendings a lending institution might provide, as well as they can give you guidance concerning the finest alternative for you and also your situation. Review your needs with your loan police officer.

The Basic Principles Of Broker Mortgage Fees

2. The Role of a Funding Police Officer in the Testing Process, Your lending police officer is your straight contact when you're looking for a finance. They will investigate and examine your financial background and also analyze whether you get approved for a home mortgage. You will not need to fret about consistently calling all individuals involved in the home mortgage financing procedure, such as the expert, realty agent, settlement attorney and others, because your funding police officer will certainly be the factor of see page get in touch with for every one of the entailed celebrations.Since the process of a financing transaction can be a complicated and also costly one, lots of consumers choose to collaborate with a human being as opposed to a computer. This is why financial institutions might have a number of branches they want to offer the possible consumers in various areas that desire to satisfy face-to-face with a finance policeman.

6 Easy Facts About Broker Mortgage Near Me Described

The Role of a Lending Officer in the Loan Application Process, The home mortgage application process can feel overwhelming, specifically for the novice homebuyer. When you work with the right lending police officer, the procedure is actually rather simple.During the finance handling phase, your lending policeman will call you see this site with any concerns the loan processors might have concerning your application. Your loan officer will certainly after that pass the application on to the underwriter, that will evaluate your credit reliability. If the underwriter accepts your financing, your finance police officer will then accumulate as well as prepare the proper financing shutting files.

All About Broker Mortgage Rates

Exactly how do you pick the ideal financing police officer for you? To begin your search, start with lending institutions who have an outstanding online reputation for exceeding their customers' expectations and also keeping sector requirements. When you've chosen a loan provider, you can then start to limit your search by talking to financing policemans you might intend to collaborate with (mortgage broker average salary).

Report this wiki page